Journal Entries

- Posted on 22 de outubro de 2024

- in Bookkeeping

- by admin

Assets increase with a debit, so accumulated depreciation is increased with a credit (opposite). The amount of insurance that was incurred/used up/expired during the period of time appearing in the heading of the income statement. The amount of insurance premiums that have not yet expired should be reported in the current asset account Prepaid Insurance. Record journal entries for the following transactions. B. Accounts receivable represents what the customer owes the company and is an asset. Assets are credited when they are decreased.

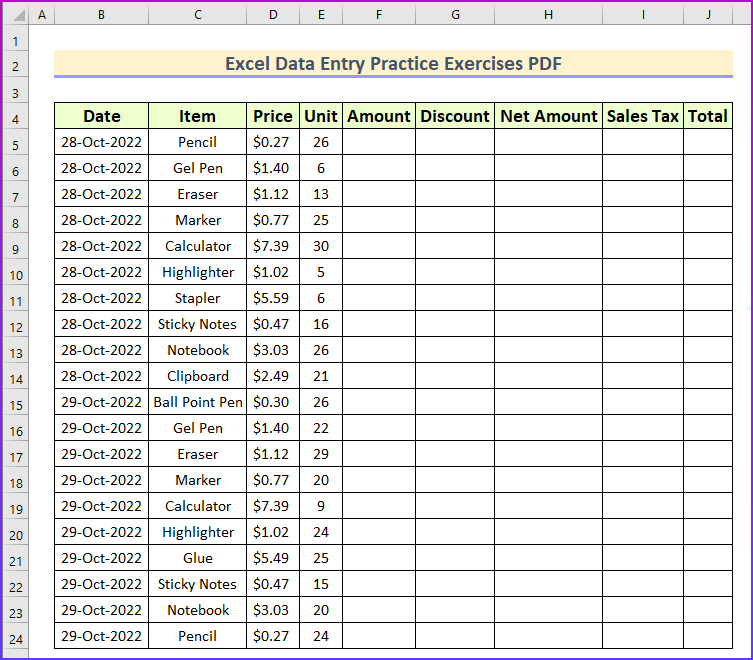

Journal Entry Practice Questions

Use the letter of the transaction in place of the date. Account balances are the amounts on the income statement and balance sheet below. Account balances will be the amounts on the income statement and balance sheet below. 1) Purchased equipment paying $4,000 cash and financing $10,000 to be repaid in monthly payments for 8 months. When following double-entry bookkeeping there needs to be at least 1 debit & 1 credit. The below image is helpful to understand the format of a journal entry.

Journal Entry for Asset Purchase

Record journal entries for these transactions. Determine the balance in the cash account at the end of the first month. Record journal entries for following transactions. After recording the transactions,prepare a “T account” and balance the cash account. C. Wages paid to employees who worked this period is an increase to an expense and a decrease to cash. Increasing an expense is a debit and decreasing cash, an asset, is a credit.

Journal Entry for Income Received in Advance

Paid $4,000 for salaries to employees who worked this month. Rented warehouse space, $5,000 was paid for this month and $10,000 was paid for the understanding taxes on life insurance premiums following 2 months. Purchased inventory at a cost of $45,000 on account. Received $150,000 cash from investors for ownership in the company.

Example – Max Withdrew 1,000 in cash for personal use from his business. Drawings are personal withdrawals made by the owner and act as a reduction in the owner’s capital. Example – Max started a business with 10,000 in cash.

- Decreasing an asset is done with a credit which is not one of the choices.

- The journal book must record every business transaction, which means entries need to be made.

- There is an increase in an asset account (Furniture and Fixtures) in exchange for a decrease in another asset (Cash).

- Purchase Returns are the goods returned by the company to the seller or creditors.

Journal Entry for Business Started (in cash)

Not yet received is a receivable which is an asset. A related account is Supplies Expense, which appears on the income statement. 20 Collected cash of $ 4,500 from customers on account (see March 12 entry). Asset and expense accounts will have a debit balance.

‘Debit all the expenses and losses and Credit all the incomes and gains. The three golden rules of journalizing are based on the nature of the account, i.e., Personal Account, Real Account, or Nominal Account. Seek information on the advantages and disadvantages of working for a CPA firm. Also, inquire about the nature of the work and the training programs offered by the firm for new employees.

However, after the financial statements for the year are prepared the current year net income and draws will be transferred to this account. Accrued expense is the liability often used for advertising expense (accounts payable is also used). B. Accumulated depreciation is always recorded as a credit when depreciation expense is incurred (debit). Depreciation expense is recorded when a long term asset is used. Depreciation expense is not paid since the cash was paid when the long-term asset was purchased. Supplies is a current asset and does not depreciate, they are used.

Accounts receivable decreases when the customer pays the company. (a.) & (c.) are recorded with a debit to accounts receivable. A. Record journal entries for the above transactions B. Make a “T” account for the cash account, post the journal entry amounts in the T account, and balance the cash account.

Determine the balance for each account.C. D. Purchasing an asset is an increase in the asset (debit). Paying cash is a decrease to the asset (credit). Paying later is an increase to a liability (credit). Total debits must always equal total debits.