Current Mortgage and you can Refinance Prices within the Washington

- Posted on 14 de novembro de 2024

- in find payday loans no credit check

- by admin

Rebecca is a self-employed factor in order to Newsweek’s personal money team. An official student loan therapist, she’s written commonly to your education loan personal debt and higher degree. Rebecca even offers secured many other individual funds subject areas, including personal loans, the fresh housing marketplace and you may consumer credit. She’s committed to permitting somebody learn their choices making advised choices regarding their currency.

Jenni try a personal loans editor and you will author. Their unique favorite subject areas are paying, mortgage loans, home, cost management and entrepreneurship. She also machines the fresh Mama’s Money Chart podcast, that helps sit-at-household moms earn much more, spend less and by taking others.

Whenever this woman is perhaps not creating or editing, you can find Jenni taking her family members for hikes along side Wasatch Top, stitching with her siblings otherwise conquering people in the Scrabble.

Rates have fundamentally started broadening over the past while, plus the newest mortgage costs in the Arizona are no exception. Based on data away from Redfin, 30-season repaired mortgage rates inside Arizona average six.667% Annual percentage rate, while you are 29-seasons repaired refinance costs from inside the Arizona mediocre eight.442% Annual percentage rate.

Knowing the interest levels during the Washington makes it possible to examine their alternatives for mortgage brokers and determine an educated financial program for your funds. As well as old-fashioned mortgages, you could envision a national-supported loan, such as for instance an FHA otherwise Va loan, otherwise mention apps getting first-big date homebuyers.

This guide explains a few of these software to possess prospective homeowners during the this new Evergreen County in order to choose the best financing choice for your home pick.

All of our research is designed to offer you a thorough information off private finance products one be perfect for your needs. To on choice-while making process, the professional contributors evaluate preferred preferences and you can prospective problems activities, eg value, entry to, and you may trustworthiness.

Current Washington Financial Pricing

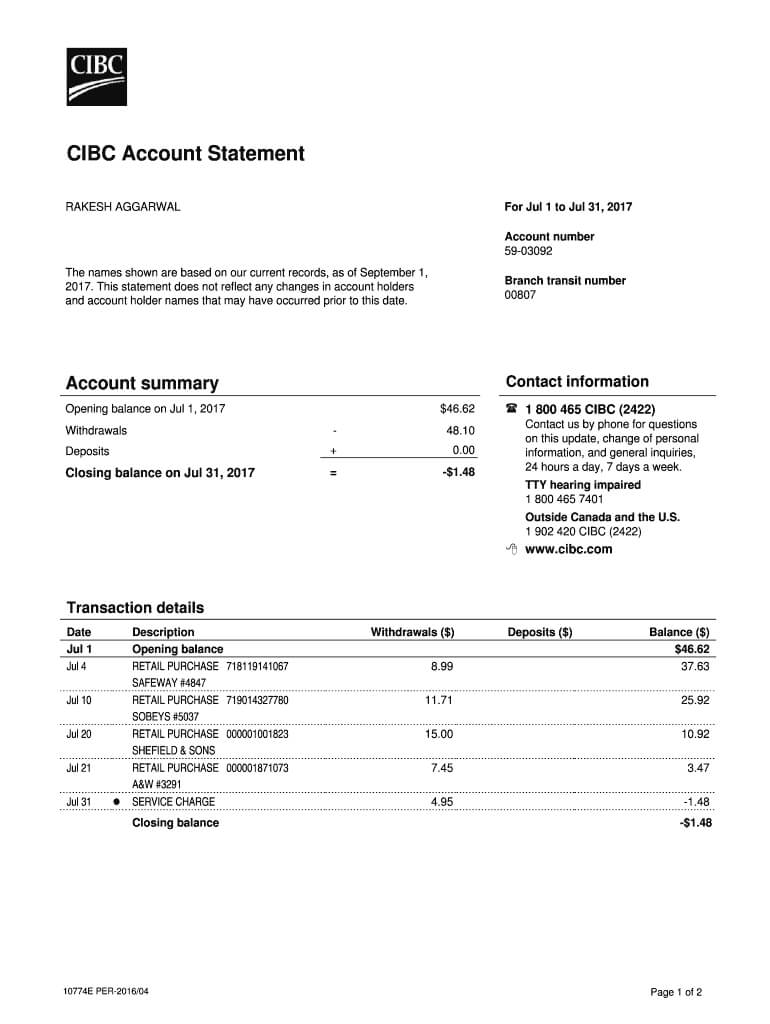

Current mortgage pricing inside Washington average as much as 6.6% to possess fifteen-12 months finance and 7.4% to have 30-12 months funds. The fresh new cost in the dining table lower than come from Redfin and its own financial www.paydayloancolorado.net/ponderosa-park/ costs companion, icanbuy, and therefore are based on an effective $320,000 financing.

The new averages and additionally assume an effective 20% advance payment and you may a credit history of 740 or more. The new dining table reveals each other rates and you can annual fee cost (APRs), being a bit other actions of borrowing will set you back.

Interest rates reference focus accrual alone, while Apr try a more inclusive name that takes fees, including handling otherwise document thinking costs, into account. As you can see, home loan costs differ dependent on multiple issues, including the length of this new repayment title, brand of interest rate (fixed or variable) and kind out of home loan, whether it’s a conventional home loan, FHA otherwise Va financing.

Refinance loan Prices into the Washington

Refinance prices when you look at the Arizona is slightly higher than this new rates for house buy financing-and you may much more greater than the two% to 3% downs inside the COVID-19 pandemic. For individuals who have a reduced speed, mortgage refinancing may well not force you to offers. That have rising home prices, even if, maybe you have a whole lot more security in order to faucet in your Washington home compared to decades early in the day.

Vault’s Thoughts: Arizona Financial Pricing Fashion inside the 2024

It is tough to predict the continuing future of home loan pricing, but it looks they will will still be rather more than these were for the pandemic for the remainder of the year. This new Federal Reserve hiked prices many times before couples from age in order to suppress rising prices.

The new Fed seems to be holding rates steady for now, however, there could be slices before the prevent of the year, which could produce a decrease in prices one of lenders nationwide plus in the condition of Washington. However, the fresh National Connection from Real estate professionals needs rates to keep ranging from six% and you can eight% while in the 2024.