Are you willing to get a mortgage while you are currently a beneficial co-signer?

- Posted on 8 de outubro de 2024

- in can you get a cash advance at a bank

- by admin

Content

You really co-finalized a car loan, education loan, otherwise mortgage to help away a relative or friend just who failed to meet the requirements independently. Nevertheless now your wanting a home loan, your a good deed helps it be more challenging becoming an effective homeowner.

You could potentially still become approved for a mortgage because the an effective co-signer, however you could need to simply take more strategies to acquire truth be told there. Less than, I falter new obligations you take as the an effective co-signer, how it change their financial app, and what you need to do to become approved.

Preciselywhat are my personal obligations as the a beneficial co-signer to your a loan?

Because the an excellent co-signer, you are similarly guilty of paying your debt. To put it differently, you only pay the debt when your borrower cannot.

Particularly, when you co-sign home financing, both you and an important debtor whom resides in the house was partners for the owning the house. Therefore, you are one another entitled toward property identity and take on your debt. Given that you are on the newest hook up on financial, you might be and additionally responsible for the fresh new monthly obligations.

How does co-signing a loan apply to my personal borrowing from the bank?

Including, fast costs towards the co-closed financing can raise your credit rating. Concurrently, later repayments, selections, and you will judgments reduce your get, so it’s harder to get credit later.

Your credit rating is extremely important from inside the determining what type of mortgage you can get. Normally, you get a lesser interest rate and you may monthly payment once you has a high credit history.

How does co-signing financing affect my loans-to-income proportion?

Co-finalizing for someone more could affect your ability to locate recognized to possess a mortgage whilst expands debt duty.

The fresh co-closed loan gets element of your current personal debt load, boosting your financial obligation-to-money proportion (DTI). Your own DTI tells the mortgage bank how much off a mortgage you really can afford centered on your income. While your DTI is just too large, the lender tend to turn down your financial app.

Essentially, the utmost DTI is actually 50%, meaning lenders curb your monthly premiums so you’re able to 50 % of your own month-to-month money. Very, brand new payment towards household we want to purchase, also any kind of financial obligation, in addition to co-closed fund, are at most 50% of one’s money.

Suppose your earnings are $ten,000 month-to-month, plus coming household percentage is actually $cuatro,000. Except that your car percentage from $five hundred, there is no need any extra bills. Very, in this analogy, you really can afford the loan and get our house since your DTI is 45%. $4,500 / $10,000 = 45%.

However co-finalized your own brother’s mortgage 2 years back to assist your get a condo. The extra $2,five-hundred debt increased the DTI to help you 70%. Unfortunately, you don’t qualify for the borrowed funds since your DTI exceeds fifty%. $4,five-hundred + $2,500 = $eight,000 / $10,000 = 70%.

How to get acknowledged getting a mortgage when you co-closed for somebody otherwise

You can purchase acknowledged to own a mortgage no matter if you may be currently good co-signer for somebody more. Listed below are some steps you can take to evolve the possibility.

For people who co-signed a non-financial obligations

Guess you co-signed a non-home loan obligations, such as for instance a credit card, car loan, or student loan. Therefore, the financial institution you will prohibit new commission out of your financial obligation-to-money proportion for individuals who check if someone else has made brand new history a dozen payments on time – not one had been 1 month or maybe more past-due.

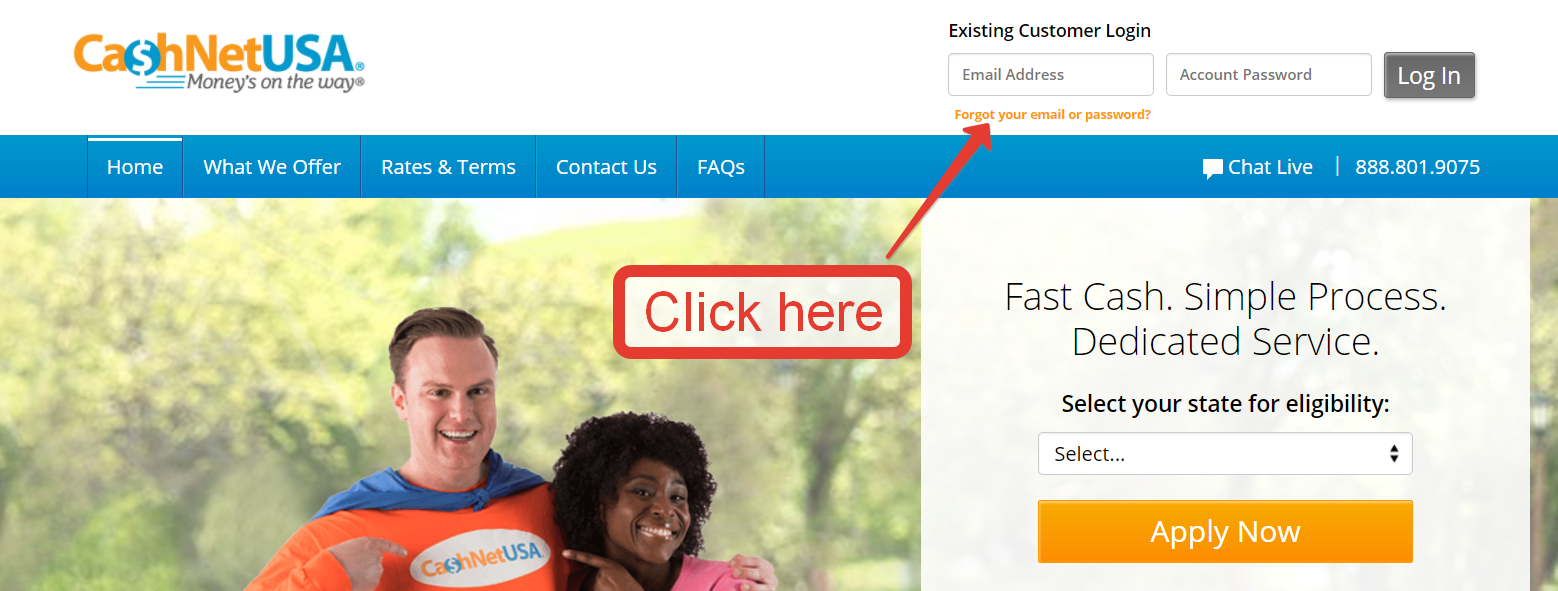

Even in the event lenders has actually more requirements, NewCastle Mortgage brokers encourage financial comments, financial purchase records, otherwise comparable files demonstrating one to some other person is paying off the personal debt. The other person shouldn’t have to https://www.paydayloanalabama.com/emelle function as borrower.

All of our buyers Alex purchased a vehicle to possess his sibling. Alex’s cousin don’t sign up for the car financing while the their borrowing is top. But the guy made the costs timely the past 12 weeks and you may sent us proof. So, i excluded the car percentage whenever figuring Alex’s debt-to-earnings ratio and you will recognized his mortgage.

For individuals who co-finalized a home loan

Loan providers generally prohibit good co-signed mortgage from the DTI just after verifying your no. 1 borrower has made the final several repayments without having to be late of the 29 weeks or higher. The person making the money must be the number one debtor which closed the borrowed funds agreement.

Amir co-closed their sister’s mortgage this past year to simply help her pick an effective domestic. Today, the guy wants to get a home.

- His brother, Nivia, are an important debtor – she finalized the latest promissory note, along with her name’s to the property’s term.

- Nivia sent united states evidence one she generated the final 12 financial money punctually.

- Because of this, i omitted new co-closed mortgage personal debt of Amir’s personal debt-to-money proportion and you will approved his mortgage.

Offer, refinance, otherwise reduce the debt.

Co-signing enables you to similarly responsible for repaying the mortgage with the first debtor. The main debtor can launch you against debt responsibility of the selling or refinancing the vehicle, education loan, household, or everything you assisted your get.

- Refinance: Imagine the key borrower’s money grows, in which he can make enough money so you can be considered on their own. Refinancing would allow your to help you safe a different sort of loan instead of their assist once the a good co-signer. In such a case, brand new loan do pay the present financing and you can release their obligations.

- Sell: Selling a property could pay off the loan, match the lender, and launch you from the debt obligation.

- Pay down your debt: If for example the top debtor can’t offer otherwise refinance, consider repaying brand new co-finalized financing in order to ten otherwise a lot fewer kept monthly premiums. This way, you can exclude new co-finalized mortgage from your personal debt-to-earnings proportion.

First, afford the mortgage equilibrium down to $5,000. Then, ban this new fee when figuring the debt-to-income ratio to suit your home loan because you have only ten money left to your co-signed mortgage.

Agenda sometime to speak that have NewCastle Mortgage brokers about your options. At NewCastle, we believe into the simplifying the borrowed funds techniques and you will strengthening all of our users into studies they must pick a house confidently.