No off mortgage loans is extremely more pricey than a timeless financing

- Posted on 27 de outubro de 2024

- in how much interest for a payday loan

- by admin

No discounts are essential. The financial institution completely finances the acquisition of the new house. All you have to love is the month-to-month mortgage repayments. Songs higher, does it not?

Such funds could potentially make it customers so you can safer an excellent assets one to other banks would not thought providing them that loan into the. Plus in Cayman’s most recent market, frequently it’s the only way some body log on to the latest possessions ladder.

Additional Costs

This is because the interest rate of which the bank will charges you attract is a lot high. So what you get make payment on financial in total attention (how much cash reduced in addition price over the label of the loan) is a lot better.

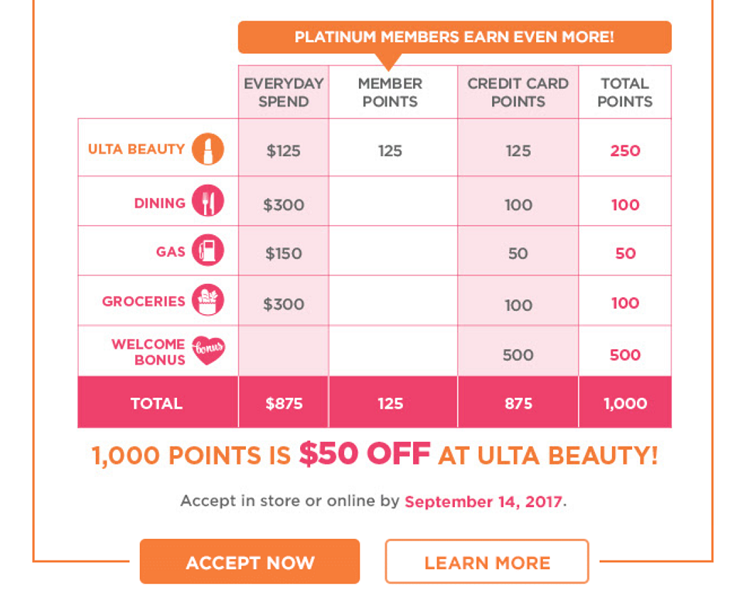

Below are a side from the top review of 100% resource and you can an elementary loan. This case is dependent on previous cost to finance an Isabela Properties property package, listed at CI$31,700 regarding Cayman Brac.

The financial institution was whenever greater risk when providing 100% money. Because of this, it costs increased interest rate to make certain they make their cash back. So even though you won’t need to provide fund initial, your sooner or later shell out a great deal more on property.

The interest rate and also the overall attention along side mortgage term are just a few products you ought to consider when comparing money choices. To possess general information about mortgages, We advice you to definitely discover my previous writings: Mortgages inside Cayman.

Added Time and Worry

For me, the latest organizations offering 100% capital mortgage loans end slowing down property conversion. How much time ranging from in the event the Offer is accepted to help you new Closing go out might be a lot longer and frequently a lot more exhausting – for all functions inside it.

If it is not a district Category A financial regarding Cayman Islands, also “pre-approvals” dont constantly be sure your a loan. The loan software need cross numerous desks, and in some cases, come-off-island in advance of capable show the loan.

Ugly Offers to Vendors

Sellers was researching the Render to order to anybody else. Of course, speed may be the largest choosing basis, but the amount of conditions, the fresh schedule to close off, as well as the brand of money normally influence if or not a vendor allows an offer.

The amount of time and you will worry that comes with 100% capital mortgage loans you can expect to dissuade suppliers out of recognizing the Promote. In short, the bank you choose personal loans for bad credit Georgia normally put you missing out.

As a buyer, this can end up being discriminatory. Why must the seller care and attention where you are getting the funds out-of? Put yourself throughout the Seller’s boots. If they can conclude the newest product sales of its assets within two months rather than four weeks and steer clear of unanticipated situations, delays, and you may concerns, following definitely, they’re going to proceed with the most simple Provide. They want to mark their property off the business although you sort out their criteria time which is often lost in the event the mortgage is not accepted.

Deposit Still Required

In initial deposit, or exactly what specific can get telephone call earnest money, is where buyers let you know providers they may not be only throwing away day. It is like a protection deposit into the revenue by itself – in case your sale experiences, you earn your bank account straight back when you’re recognized having 100% funding. However, you nonetheless still need to have the financing in your account, prepared to put down once you help make your Render to the vendor. This type of funds was after that held in escrow (a new carrying account) before the property exchange is complete. Sadly, it is not uncommon, especially for earliest-big date consumers, seduced by the 100% resource in the bank, to overlook needing fund towards the deposit.