Ask united states what re-finance speed we could give you

- Posted on 28 de outubro de 2024

- in how much of a payday loan can i get

- by admin

You could decrease your price and you may payment from the refinancing your residence! That have a normal loan, you can purchase an aggressive interest rate if you have an effective borrowing from the bank and you will money. You could potentially avoid purchasing private home loan insurance rates if the home equity are 20% or higher, as well.

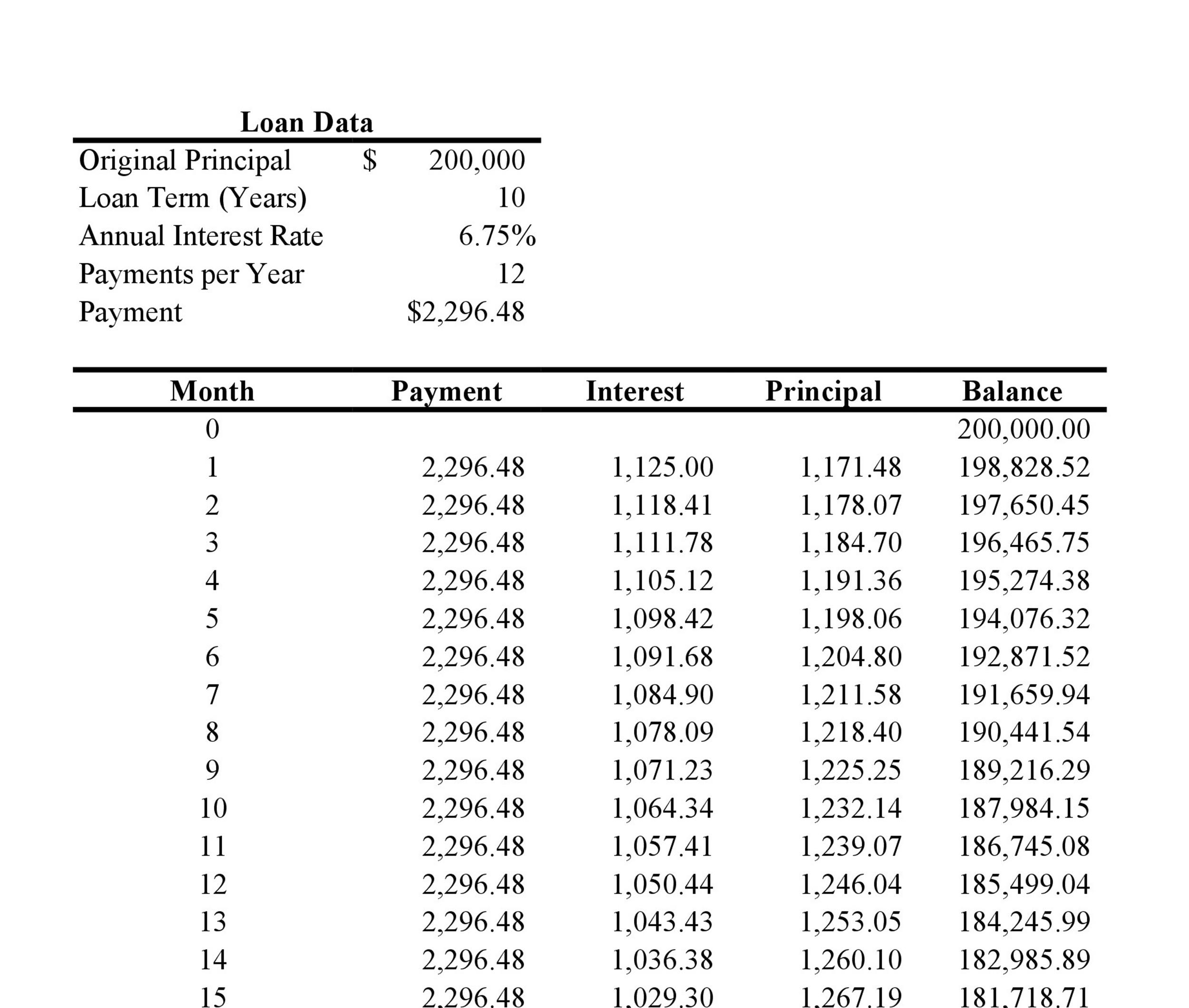

Use the calculator lower than to help you estimate how much you might rescue that have a home loan refinance. Please be aware you to because of the refinancing, the full finance charges you only pay could be higher across the lifetime of the mortgage.

Old-fashioned Refinances

- Far more papers

- Minimal credit score will 620

- No home loan insurance policies which have 20% collateral

- Zero financial support fee

Virtual assistant Improve Refinances

- Less documentation

- No home loan insurance policies

- Money commission necessary

FHA Streamline Refinances

- Reduced papers

Simply how much might you save yourself?

See how much you can rescue of the refinancing your house in order to a diminished rate. From the refinancing, the total loans charges you have to pay tends to be higher along the longevity of the loan. Change the default thinking so you’re able to customize your savings guess!

The house refinance rates we may manage to promote is personal to you personally. The interest rate try influenced by the kind of refinance loan need, your credit rating, your revenue and you may earnings, additionally the newest mortgage business environment. Independence Home loan might be able to offer a refinance rate that’s down – or maybe more – compared to the price the thing is advertised of the other lenders. Ask all of us today what refinance speed we can give you.

Is mortgage refinancing sensible?

Normally, refinancing your own home loan would be best when the current focus rates is actually somewhat less than the speed in your current financial.

That is because you’ll want the fresh new discounts regarding refinancing, over time, getting worth every penny when you spend the money for re-finance closing costs.

The easiest way to decide if refinancing makes sense is always to determine some slack-even point, that’s in case the savings is actually equivalent to your own costs. Such as, if your settlement costs is actually $dos,eight hundred, and you are protecting $100 per month on your own the new financing, it takes 2 years (2 years x $100 per month) to break actually.

Refinancing is going to be best when you achieve your split-also part quickly otherwise when you propose to reside in your household for decades. You might use the fresh new savings to reduce the monthly payment or repay their financial easier.

After you refinance, it’s also possible to change the number of years you have to repay their home loan, button out of a changeable-speed in order to a fixed-rate home loan, and. Discover more about reasons to re-finance.

How can home loan refinances performs?

You need to pay back your current financial and you can change it that have a new financial who may have ideal pricing or conditions in order so you’re able to refinance your house with a normal loan.

You’ll need to over a separate home loan software, submit records, indication disclosures, and you may sit-in the latest closing. You’ll also must meet all of our conditions locate acknowledged. They truly are:

Versatility Mortgage’s educated Mortgage Advisers work with you and also make every step out-of refinancing your residence much easier and you may issues-free. Find out more about all of our financial app process.

Preciselywhat are your mortgage refinance cost?

The mortgage refinance price we possibly may have the ability to render are individual for your requirements. Their interest rate try influenced by the type of refinance mortgage you prefer, your credit rating, your revenue, and you can profit, and the current mortgage industry ecosystem.

Independence Financial might possibly offer a good re-finance price that is down-or more-compared to the rates the truth is reported from the most other lenders. Query all of us today just what refinance rates we are able to provide you with by the getting in touch with 877-220-5533.